Buying a house in Michigan can be an exciting and fulfilling experience. Known for its diverse landscapes, vibrant cities, and affordable housing options, Michigan offers prospective homebuyers a range of opportunities. Whether you’re looking for charming suburban homes in Grand Rapids, a bustling urban condo in Ann Arbor, or a serene rural retreat, Michigan has something to offer. However, navigating the homebuying process in Michigan requires careful consideration of factors such as location, market conditions, financing options, and legal requirements. Understanding the local real estate market, working with knowledgeable professionals, and conducting thorough research is vital to making informed decisions and finding the perfect home in Michigan.

If you’re a first-time homebuyer and want to know more about the market, Redfin has your back. From market insights to the homebuying process, read on to get started.

What’s it like to live in Michigan?

Michigan is known for its breathtaking natural beauty, including the Great Lakes, stunning forests, and picturesque landscapes. Residents can enjoy various outdoor activities like hiking, camping, boating, and skiing. Furthermore, Michigan boasts excellent educational institutions, including renowned universities like the University of Michigan and Michigan State University. The cost of living in many areas of Michigan is relatively affordable compared to other states, allowing residents to enjoy a comfortable lifestyle. Check out this article to learn more about the pros and cons of living in Michigan.

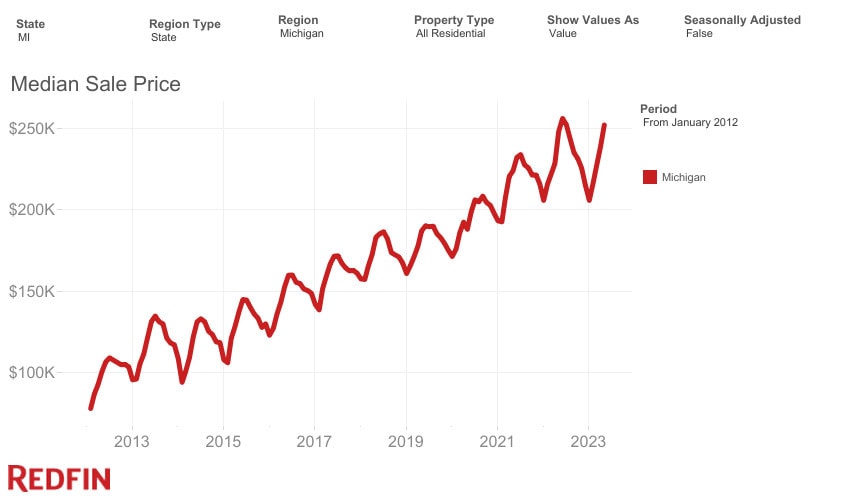

Michigan housing market insights

The housing market in Michigan continues to show increased median sale prices. As of recent data, the median sale price stands at $252,200, reflecting a 1.6% year-over-year increase. However, Due to the growth in prices, certain metros within the state are experiencing high levels of competition. Areas such as Fraser, Walker, and Clawson have become particularly competitive for homebuyers. Additionally, the number of homes available for sale has declined, down 8.3% year-over-year. This reduced inventory can contribute to a more competitive market and potentially drive up prices further. These insights indicate a dynamic housing market in Michigan, with rising costs, pockets of intense competition, and limited inventory, making it essential for prospective buyers to stay informed and be prepared for the market’s challenges and opportunities.

Finding your perfect location in Michigan

Finding the perfect location in Michigan is crucial when buying a house in the state. Michigan offers a diverse range of communities, each with its unique characteristics and amenities. Factors such as proximity to schools, job opportunities, recreational activities, and community services play a significant role in determining the suitability of a location.

If you’re between two cities you love, don’t fret; using tools like a cost of living calculator will provide insight into which city aligns with your budget. And to help you get started, we’ve compiled a list of five sought-after Michigan cities, highlighting market insights and their unique offerings.

#1: Detroit, MI

Median home price: $75,000

Detroit, MI homes for sale

As the largest city in Michigan, moving to Detroit offers a unique experience that is shaped by its rich history, cultural diversity, and ongoing revitalization efforts. Detroit’s sports culture runs deep, with passionate fan bases for teams like the Detroit Tigers, Pistons, and Red Wings. Additionally, Detroit’s revitalization efforts have led to the revitalization of neighborhoods such as Midtown and Corktown, where new businesses, art galleries, and entertainment venues have emerged.

#2: Kalamazoo, MI

Median home price: $190,500

Kalamazoo, MI homes for sale

The cost of living in Kalamazoo, MI is 21% lower than the national average, perfect for those on a budget. The city is known for its lively arts scene, with the Kalamazoo Institute of Arts, the Kalamazoo Symphony Orchestra, and numerous theater companies providing a rich cultural experience. Residents can explore the vibrant downtown area, filled with local shops, restaurants, and breweries, including the popular Bell’s Brewery. Kalamazoo offers a range of outdoor recreational activities, with parks, hiking trails, and proximity to scenic areas such as the Kalamazoo River Valley Trail and the Kal-Haven Trail. So if you’re looking for a small town with a low cost of living, moving to Kalamazoo could be for you.

#3: Grand Rapids, MI

Median home price: $290,000

Grand Rapids, MI homes for sale

Moving to Grand Rapids offers a rich and fulfilling experience with a unique blend of urban amenities and natural beauty. Grand Rapids is known for its thriving craft beer scene with numerous breweries and festivals. It was even named Beer City, USA. The city boasts a rich cultural landscape, including the renowned Frederik Meijer Gardens and Sculpture Park, the Grand Rapids Art Museum, and the Gerald R. Ford Presidential Museum. With a strong emphasis on the arts, Grand Rapids hosts ArtPrize, one of the world’s largest art competitions.

#4: Novi, MI

Median home price: $390,000

Novi, MI homes for sale

Moving to Novi offers a delightful experience with its upscale shopping destinations. You’ll find the Twelve Oaks Mall and the luxurious Novi Town Center, providing residents with a wide range of shopping and dining options. The city also boasts several parks and recreational areas, including the picturesque Lakeshore Park, which offers trails, picnic spots, and beautiful views of Walled Lake. Moreover, Novi is renowned for hosting the annual Michigan State Fair, a lively event showcasing agricultural exhibits, captivating entertainment, and exhilarating rides.

#5: Ann Arbor, MI

Median home price: $496,250

Ann Arbor, MI homes for sale

As the home of the University of Michigan, Ann Arbor has a lively and intellectual atmosphere. The city is renowned for its top-tier education, world-class research facilities, and a strong emphasis on innovation and entrepreneurship. Residents can take advantage of various cultural events, including the Ann Arbor Film Festival, the Ann Arbor Art Fair, and the renowned University Musical Society, which brings diverse performing arts to the community. The vibrant downtown area is filled with local shops, restaurants, and cafes, creating a lively and welcoming environment for anyone moving to Ann Arbor.

The homebuying process in Michigan

Let’s explore the homebuying process if you’re ready to put down roots in Michigan.

1. Prioritize your finances

Prioritizing your finances when buying a home in Michigan is crucial for several reasons. First and foremost, it ensures that you can comfortably afford the financial obligations associated with homeownership. By assessing your income, expenses, and budget, you can determine a realistic price range and avoid overextending yourself financially. Along with prioritizing your finances to help secure a favorable mortgage loan with competitive interest rates and terms. If you’re not sure where to start, using tools like an affordability calculator will point you in the right direction.

Various programs are available for first-time homebuyers in Michigan, including the MI Home Loan, which can assist with up to $7,500 in down payment assistance.

2. Get pre-approved from a lender

Getting pre-approved from a lender is an essential first step when starting the homebuying journey. By seeking pre-approval, you gain a clear understanding of your budget and financial limitations, which allows you to search for homes within your price range. Pre-approval involves a lender evaluating your financial situation, credit history, and income to determine the loan amount you qualify for.

3. Connect with a local agent in Michigan

When buying a house, connecting with a local real estate agent in Michigan is essential, as they bring valuable expertise, guidance, and local market knowledge. A local agent understands the nuances of the Michigan real estate market, including neighborhood trends, property values, and inventory availability. They can help you identify suitable neighborhoods that align with your preferences and budget. So whether you’re looking for real estate agents in Grand Rapids or agents in Detroit, they’re here to help.

4. Start touring homes

Touring homes is a crucial step in the homebuying process, as it allows you to experience and evaluate properties first hand physically. It provides an opportunity to assess a home’s condition, layout, and overall appeal before making a purchasing decision. During home tours, paying attention to several key factors is essential. First, consider the home’s structural integrity and potential maintenance issues. Look for signs of water damage, cracks in the foundation, or any other red flags that could indicate significant repairs or maintenance expenses down the line.

5. Make the offer

Making an offer signifies the buyer’s serious intent to acquire the home and initiates the negotiation phase. When crafting an offer, prospective buyers must consider the property’s market value, comparable sales in the area, the seller’s asking price, and their budget and preferences. The offer should be presented in writing and include essential details such as the proposed purchase price, desired contingencies, and the seller’s response deadline.

6. Close on the house

The closing process is the final stage, where all the necessary legal and financial transactions are completed, and property ownership is officially transferred from the seller to the buyer. During the close, various important tasks take place, including reviewing and signing the final purchase agreement, verifying the title and property records, completing the mortgage paperwork, and paying closing costs and fees. Additionally, the close allows the buyer to conduct a final walkthrough of the property to ensure its condition is as expected.

If you’re new to the process, Redfin has insights for you. The First-Time Homebuyer Guide has everything you need to know about each step of the process.

Factors to consider when buying a house in Michigan

When going through the homebuying process, you’ll want to understand the unique considerations of buying a home in Michigan.

Water rights

Michigan has strict regulations regarding water rights, particularly in properties with access to lakes, rivers, or streams. When purchasing a house, understand the extent of your water rights, restrictions, and availability for everyday use or irrigation.

Flood risks

Michigan faces significant flood risks due to its unique geographical features and weather patterns. The presence of the Great Lakes exposes many areas to potential flooding. Additionally, Michigan has numerous rivers, streams, and inland lakes, which can contribute to the likelihood of flooding during heavy rainfall or snowmelt events. The state’s climate, characterized by cold winters and frequent precipitation, can lead to rapid snow accumulation and subsequent spring thaws, increasing the risk of flooding. Knowing if your house is in a flood zone is essential, so you can be prepared.

Dual agency

A dual agency is permitted when buying a house in Michigan. A dual agency is when a real estate agent or broker represents the buyer and seller in the same transaction. In Michigan, this practice is allowed as long as it is disclosed and agreed upon by all parties involved. However, it is advisable for buyers to carefully consider the implications of dual agency, as the agent’s loyalty and fiduciary duty may become divided between the buyer and the seller.

High closing costs

Michigan is known for having relatively high closing costs when buying a home. On average, homeowners will spend around $5,714. Closing costs encompass various fees and expenses that buyers incur during the final stages of a real estate transaction. In Michigan, these costs typically include property taxes, title insurance, attorney fees, appraisal fees, loan origination fees, and recording fees.

Buying a house in Michigan: Bottom line

Michigan’s real estate market provides a diverse selection of housing options, encompassing both affordable areas and higher-priced cities. The affordability and availability of homes depend on factors such as location, market conditions, and individual budgets. To navigate this market successfully, it is crucial to conduct thorough research on the desired area, track market trends, and assess personal financial readiness, including credit score and down payment savings. By gaining a comprehensive understanding of the homebuying process, you can embark on your journey towards homeownership in Michigan with confidence.

Buying a house in Michigan FAQ

What credit score is needed to buy a home in Michigan?

The credit score needed to buy a home in Michigan, as in any other state, can vary depending on the lender and the type of mortgage loan. However, generally speaking, a higher credit score is advantageous when applying for a mortgage. Most conventional lenders prefer borrowers to have a credit score of 620 or higher. This shows a strong credit history and a lower loan default risk. Additionally, loan programs are available that cater to borrowers with lower credit scores, such as FHA loans, which typically require a credit score of 500 or higher.

What is the required down payment for buying a house in Michigan?

The down payment required to buy a house in Michigan, as in other parts of the United States, can vary depending on several factors, including the type of mortgage loan you’re using and the lender’s requirements. Typically, conventional mortgage lenders may require a down payment of 3% to 20% of the home’s purchase price. For example, if you’re buying a $200,000 home, a 3% down payment would amount to $6,000, while a 20% down payment would be $40,000. However, it’s important to note that there are loan programs available that may require lower down payments. For instance, FHA loans often require a down payment of 3.5% of the purchase price, while VA loans and USDA loans offer the option of zero down payment for eligible borrowers.

Are home prices affordable in Michigan?

Whether buying a house in Michigan is considered cheap depends on various factors, including the specific location within the state, the local real estate market conditions, and individual budget constraints. For example, in Kalamazoo, housing costs 47% less than the national average, whereas housing in Ann Arbor is 16% more than the national average. As a whole, Michigan has been known to offer more affordable housing options compared to some other states in the United States. However, prices can still vary significantly depending on the city or region. Consulting with a local real estate agent or professional can provide valuable insights into the desired area’s current market conditions and pricing trends.

The post The Ultimate Guide to Buying a House in Michigan appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.

from Redfin | Real Estate Tips for Home Buying, Selling & More https://ift.tt/IkYlbU2

No comments:

Post a Comment