Buying a home in Florida can be an exciting, yet daunting process. As one of the most popular places to live in the country, Florida offers many housing options to fit any budget and lifestyle. From beachfront condos to suburban single-family homes, the state’s diverse real estate market can make deciding where to start your search challenging.

Florida’s unique weather patterns, flood zones, and homeowner’s insurance requirements can add extra considerations to the homebuying process. However, with proper research and guidance from experienced professionals, buying a home in Florida, whether you’re a first-time homebuyer or planning your retirement, living in Florida can be a rewarding experience that leads to a lifetime of enjoyment in the Sunshine State.

What’s it like to live in Florida?

Florida is a popular destination for those who love the sun, known for its sunny beaches, theme parks, and warm weather. But for long-time Floridians, there’s much more to the state than its popular attractions. Florida has something special, from the bustling cities of Miami and Tampa to the quaint coastal towns of the Panhandle and the serene natural beauty of the Everglades and the Keys. You’ll find it here whether you’re looking for a fast-paced urban lifestyle or a laid-back beach community. However, living in Florida also comes with challenges, such as the occasional hurricane and high humidity in the summer months. But for those who embrace the state’s unique character and culture, living in Florida can be an exciting and fulfilling experience. Check out this article to learn more about the pros and cons of living in Florida.

An overview of the Florida housing market

The Florida housing market is known for its diversity, with various options available to buyers at all price points. The state’s real estate market has thrived in recent years, with strong demand from residents and out-of-state buyers. The state has seen a significant increase in new construction, with builders developing homes in both urban and suburban areas to meet the demand for housing.

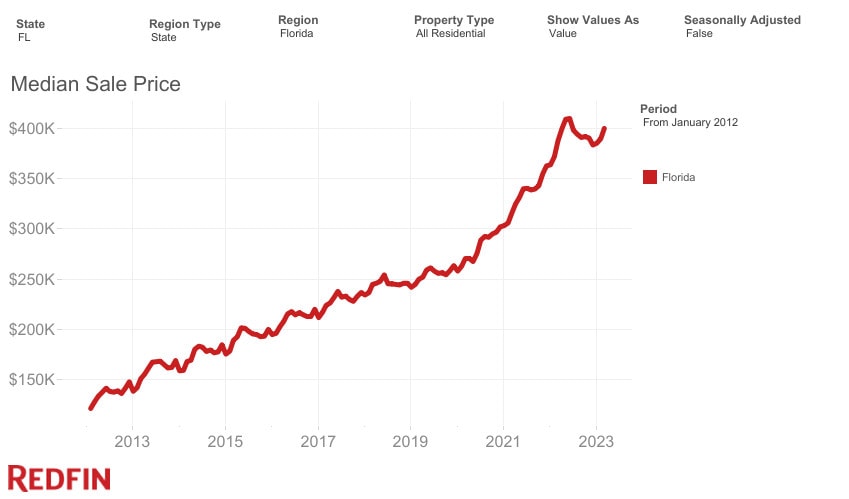

Florida’s median sale price has been steadily rising in the last decade, with a significant spike in 2020-2021. Presently, the median sale price stands at $400,000, comparable to the previous year. The growing population of Florida is a significant driver of the price growth, with people moving from other states, particularly the Northeast, in search of warmer weather and a lower cost of living. The high demand for homes in Florida has resulted in a shortage of available properties, particularly in popular areas like Miami, Tampa, and Orlando. Consequently, the lack of supply has led to increased home prices, making it challenging for some buyers to find affordable housing.

Finding your perfect location in Florida

When buying a house in Florida, it’s important to pick the right location as it will not only impact the types of homes on the market, but also the lifestyle you’ll have. Whether you’re looking for a family-friendly neighborhood, a retirement community, or a bustling urban area, each location offers a unique blend of amenities, culture, and atmosphere. Additionally, each city in Florida has its own set of factors to consider, such as weather patterns, flood zones, and commute times. With so many options, using tools like a cost of living calculator can help you decide within budget.

Below is a collection of some of the most sought-after cities in Florida, along with insights on their housing markets.

#1: Miami, FL

Median home price: $565,000

Miami, FL homes for sale

Living in Miami is an experience like no other. The city boasts a vibrant and diverse culture influenced by its Latin American and Caribbean roots. With year-round sunshine, beautiful beaches, and a thriving entertainment scene, Miami is a popular destination for tourists and locals alike. However, living in Miami also comes with challenges, such as a high cost of living. When comparing Miami and Tampa, the cost of living in Miami is 21% higher than in Tampa. If you have your heart set on Miami, it may be worth considering these affordable Miami suburbs.

#2: Tampa, FL

Median home price: $410,000

Tampa, FL homes for sale

Known as the Sunshine City, living in Tampa boasts over 246 sunny days per year, making it an ideal location for those who enjoy outdoor activities. The city has a diverse community with a rich history and vibrant cultural scene. You’ll also find many professional sports teams to cheer for, including the Tampa Bay Buccaneers. From the lively nightlife of Ybor City to the serene beauty of Bayshore Boulevard, there are various places to love. If you’re interested in locations outside the city, check out these affordable Tampa neighborhoods.

#3: Jacksonville, FL

Median home price: $297,000

Jacksonville, FL homes for sale

Jacksonville offers a unique experience for those looking for a mix of city and beach living. The city is the largest in the state by land area, providing a variety of neighborhoods and communities to choose from. Living in Jacksonville means you’ll be surrounded by a thriving arts and culture scene, including museums, theaters, and art galleries, as well as a range of outdoor activities, including hiking, fishing, and surfing. However, Jacksonville can also experience high humidity during the summer months and, like other parts of Florida, is at risk for hurricanes and tropical storms.

#4: Orlando, FL

Median home price: $360,000

Orlando, FL homes for sale

Orlando is known for its warm climate, lush vegetation, and entertainment scene. Living in Orlando offers residents an exciting atmosphere from charming neighborhoods and theme parks. It’s also home to several universities and colleges, making it an excellent place for those seeking higher education. Overall, if you’re looking for a city full of energy and excitement, with a variety of amenities and attractions to enjoy, Orlando could be the perfect place to buy a house.

#5: Fort Lauderdale, FL

Median home price: $515,000

Fort Lauderdale, FL homes for sale

Living in Fort Lauderdale is something to consider for those seeking a lifestyle of sunshine, beaches, and a vibrant community. The city is located on the east coast of Florida and boasts over seven miles of beautiful beaches. Fort Lauderdale is a popular destination for tourists and locals alike, known for its luxury yachts, bustling nightlife, and diverse restaurants and shops. However, living in Fort Lauderdale can also come with challenges, such as the high cost of living. For example, housing in Fort Lauderdale is 8% higher than in Miami.

To learn more about popular Florida cities, check out this article on the Fastest-Growing Cities in Florida.

The homebuying process in Florida

If you’ve decided that Florida is your state and have pinpointed the ideal location, let’s explore what purchasing a home entails.

1. Get your finances together

It’s important to prioritize getting your finances in order when buying a house in Florida. This means assessing your financial situation, reviewing your credit score, and determining your budget for a home purchase. Using tools like an affordability calculator will help you decide where to start.

There are a few first-time homebuyer programs in Florida that can offer assistance. The ECHFA Classic DPA Program offers first-time homebuyers up to $7,500 in down payment assistance. Familiarizing yourself with these programs can significantly enhance your homebuying experience.

2. Get pre-approved from a lender

Before you start looking for a house in Florida, you first need to pre-approved for a mortgage. This involves submitting your financial information to a lender who will evaluate your creditworthiness and determine the maximum loan amount you are eligible for. Pre-approval helps you understand the price range of homes you can afford and saves you time by allowing you to focus on properties that are within your budget. Additionally, pre-approval can provide a competitive advantage in the Florida housing market, where demand can be high. Check out this article to learn more about what mortgage loan is right for you.

3. Connect with a local agent in Florida

A real estate agent is essential when buying a home in Florida. They possess local market knowledge, can guide you through the homebuying process, and negotiate on your behalf to secure the best deal. Whether you’re looking at real estate agents in Miami or agents in Orlando, a real estate agent can provide valuable insight into different neighborhoods, school districts, and property values to help you find the perfect home in your desired location. They can also help with essential tasks such as scheduling inspections, reviewing contracts, and arranging for the sale’s closing.

4. Search for homes

Touring homes allows you to assess the property’s condition, evaluate its features and amenities, and determine if it meets your needs and preferences. You can also take the opportunity to ask questions and gather more information from the seller or their agent, which can aid in making an informed decision. In Florida, you can tour by attending open houses, scheduling private showings, or even taking virtual tours.

5. Make an offer

The offer is a vital part of the homebuying journey in Florida, as it marks the beginning of negotiations between the buyer and seller. This is when the buyer formally expresses their interest in the property and makes an offer to purchase it. The seller can accept, reject, or counter the offer, and the negotiation begins.

The buyer needs to work with a real estate agent to craft a competitive and reasonable offer that reflects the current market conditions and their budget. The offer can also include contingencies such as financing, appraisal, and a home inspection, which can provide the buyer with a way out of the purchase if certain conditions are unmet.

6. Close on the house

The last step in the homebuying process in Florida is the closing, where the buyer takes possession of the property, and the ownership is transferred from the seller to the buyer. The close is critical to ensure all legal and financial obligations are met, and the transaction is completed smoothly. During the close, the buyer will review and sign various documents, including the mortgage and the deed, and pay the closing costs. Florida has some of the highest closing costs in the country, so it’s important for buyers to budget for these expenses, which can include title insurance, appraisal fees, and loan origination fees.

If you’re a first-time homebuyer, you can expand your knowledge of the entire homebuying process with our First-Time Homebuyer Guide.

Things to consider when buying a house in Florida

When buying a home in Florida, it’s essential to be aware of the unique aspects that come with buying a home on this site such as the types of loans, taxes, insurance, and disclosures.

Natural disasters are common

Due to its location, Florida is known for experiencing natural disasters, such as hurricanes and floods. Therefore, it is crucial for someone wanting to buy a house in Florida to be aware of the potential risks and take necessary precautions to protect their investment, such as understanding how much home insurance you need and prepping for every type of natural disaster.

Condominiums

Condos in Florida are very popular. So if you’re planning to buy one, its important to know that a condo’s homebuying process differs from a single-family home. The buyer may need to factor in additional costs, such as monthly association fees and special assessments, and should also be aware of the condo association’s rules and regulations before making an offer. Check out this article on how to buy a condominium.

Closing costs and title insurance

Florida has some of the highest closing costs in the country, making it an essential consideration for homebuyers. The closing costs in Florida include various fees, such as title search and insurance, appraisal, taxes, and lender fees. These costs can add up quickly and significantly impact the home’s overall cost. It’s crucial for buyers to factor in these expenses when budgeting for a home purchase in Florida.

The payment responsibility for title insurance can vary depending on the county in Florida. However, it’s important to note that this is not mandated by law, and negotiation is always possible. In some counties, it’s customary for the seller to pay for title insurance; in others, the buyer is responsible for this expense. It’s essential for homebuyers to work with their real estate agent or attorney to understand who pays for title insurance and negotiate the terms according to their preferences.

The Homestead exemption

The Homestead Exemption in Florida is a program that provides a tax break to permanent residents who make their primary residence in Florida. The program allows eligible homeowners to exempt up to $50,000 of the assessed value of their home from property taxes. To qualify for the Homestead Exemption, the homeowner must have owned the property on January 1st of the tax year and used it as their primary residence. The homeowner must also file for the exemption by March 1st of the tax year. The Homestead Exemption can help reduce the property taxes homeowners pay in Florida and is an essential consideration for anyone looking to buy a home in the state.

Buying a house in Florida: Bottom line

Buying a house in Florida can be an exciting journey, but it’s important to understand the differences in the process. From the prevalence of natural disasters to the high closing costs and the availability of condominiums, there are many important considerations to remember. By working with a knowledgeable real estate agent, prospective homebuyers can confidently navigate the Florida real estate market and make informed decisions about their new home.

Buying a house in Florida FAQ

How much money do you need to buy a house in Florida?

The amount of money needed to buy a house in Florida varies depending on several factors, such as the location, size, and condition of the property, as well as the down payment and closing costs. The median list price in Florida is $460,000 and with a down payment around 3-20% plus closing costs, expect to have enough cash on hand to cover these costs. It’s important to carefully budget and save for a house to ensure you have enough funds to cover all the expenses of buying a house in Florida.

Is it worth buying a house in Florida?

As with any investment, buying a house in Florida comes with risks and potential rewards. While there are many factors to consider, such as the local housing market, property values, and potential rental income, Florida’s growing population and strong economy make it a desirable location for long-term real estate investment. However, it’s essential to do thorough research and carefully consider your financial situation before making any investment decisions. It’s equally just as important to consider the potential climate risks associated with hurricanes, floods, and other natural disasters that may affect the property in Florida.

What is a good credit score to buy a house in Florida?

A good credit score when buying a house in Florida is needed, as it is in other states. Generally, a credit score of 620 or higher is required to qualify for a conventional mortgage loan. However, higher credit scores can lead to better interest rates and loan terms. Some lenders may also have different credit score requirements, so shopping around and comparing options is important. It’s also worth noting that some government-backed loan programs, such as FHA loans, may have lower credit score requirements.

The post The Ultimate Guide to Buying a House in Florida appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.

from Redfin | Real Estate Tips for Home Buying, Selling & More https://ift.tt/bCBH0Tq

No comments:

Post a Comment